-

Parties Dispute The Terms Of An Art Insurance Policy

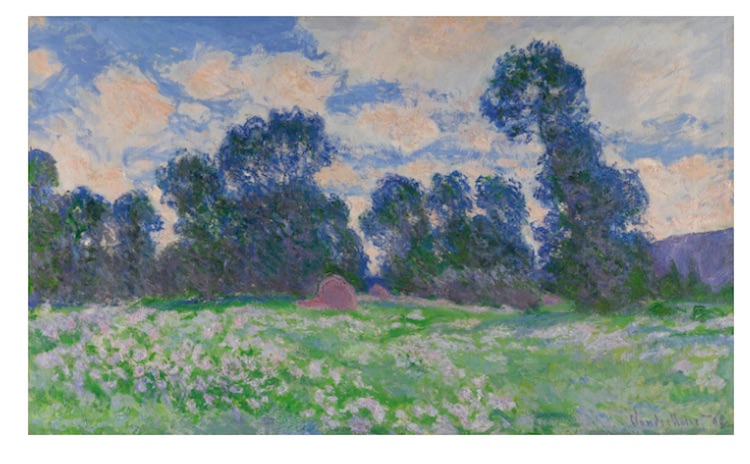

In Litigation Over Destroyed Monets10/12/2023 In June of 2022, on the shore of Lake Michigan, a fire destroyed the lake house of hedge fund founder Matthew Halbower and his wife Julie. Now, in a lawsuit pending in federal court, the family’s trust seeks an insurance payout for several valuable artworks destroyed in the fire, including four Monet paintings. The case highlights the complexity of insurance disputes involving fine art.

In June of 2022, on the shore of Lake Michigan, a fire destroyed the lake house of hedge fund founder Matthew Halbower and his wife Julie. Now, in a lawsuit pending in federal court, the family’s trust seeks an insurance payout for several valuable artworks destroyed in the fire, including four Monet paintings. The case highlights the complexity of insurance disputes involving fine art.

Overview of the Case

According to court filings and press coverage surrounding the case, the Halbower Legacy Trust made a claim to their insurer, Hiscox, shortly after the fire. On August 4, 2022, Hiscox paid out an amount Hiscox claimed fully covered its obligations for three works. But the Halbowers claim that the amounts paid for those works—referred to cryptically in the complaint only as the Cliff, the Path and the Castle—were inadequate, and further, that Hiscox should have also covered the loss of two other works, referred to as the River and the Prairie. Since then, the works have been identified with more specificity: the Castle work was by French painter Francis Picabia, and the other four works were by legendary Impressionist Claude Monet.

Art Insurance: Not So Simple

The Halbowers’ case illustrates an important lesson for art collectors, investors, dealers, and anyone insuring fine artwork: topics that seem like basic questions about your insurance policy can turn out to be more complicated than you thought.

One major question in the case is the proper interpretation of what exactly is insured under the policy. The trust urges that the policy covers all “fine art” owned by the Halbowers up to an insurable limit of over $93 million, while Hiscox argues that coverage was limited only to specific pieces. The parties had each asked the court early in the case to adopt their respective interpretations, but this spring, the court denied both motions, holding that the requests were premature where there was not a full record after discovery. (Interestingly, the very nature and makeup of the insurer itself is also raising issues in the case. Hiscox is a “syndicate” affiliated with Lloyd’s of London, which is an insurance market made up of unincorporated groups of investors (called syndicates) who appoint agents (called underwriters) to act on their behalf. Here, the parties dispute the extent to which the Hiscox syndicate’s individual members should be subject to discovery regarding their understanding of the policy).

Another issue that comes up frequently in insurance-coverage matters, and which will likely be an important issue in the Halbower case as well, is how to value the lost artworks. The works were regularly appraised, but the most recent appraisal (from just a couple of months before the fire) had not been shared with the insurer until after the fire; Hiscox, for its part, argues that an earlier appraisal from mid-2021 should determine the works’ values.

Insurance litigation can be time-consuming and complex, often involving expert witnesses and cross-border considerations. Art collectors can take proactive steps to avoid becoming embroiled in disputes like this in the first place. For example, any conversation about insuring art should also examine what systems and measures are in place to prevent loss or damage to artwork. Owners should seek advice to ensure they understand the terms of the insurance policy and their responsibilities under it. Diligent record-keeping and timely correspondence (including keeping an insurer updated on changes in the collection and its value) can also go a long way toward avoiding problems should a claim arise, and may play an important role in any litigation.

Art Law Blog